Email: hamish@transparently.ai

One of the marvellous things about AI platforms is that they can be tweaked to answer far more questions than the original design spec ever intended.

Our system, for example, casts new light on the age-old phenomenon of small cap outperformance and the absolute necessity for active rather than passive management of small cap funds.

To be sure, the process of tweaking an AI system is not simple. It requires a good deal of supplication to the Engineering Department and an element of bribery. Every engineer has her price.

Having paid the requisite offering of Tim Tams, chocolate fudge and Red Vines we at transparently.AI are able to say a good deal about firm size and the risk of accounting manipulation. We are able to quantify the relative risk of small versus large companies.

“We are able to quantify the relative risk of small versus large companies.”

Let’s kick off with a few basics. Our AI engine is called Casper. Casper is short for clever accounting sleuth predicts errant reporting. ![]()

Now Casper is a single-minded brute. He has but one objective, which is to calculate the risk that a company might be manipulating its accounts.

Casper uses an assemblage of data, combined in ways that would confound a chess champion, to spit out a single number. That number is called the “accounting manipulation risk score”. This risk score is best thought of as the joint probability of manipulation, its seriousness and the likelihood of corporate failure. Hence, it is a direct measure of corporate governance (the ‘G’ in ESG).

“The risk score is best thought of as the joint probability of manipulation, it’s seriousness and the likelihood of corporate failure.”

The best way to think of this is to consider the difference between misreporting your golf handicap to a stranger, misrepresenting blood type at the blood bank, and misrepresenting your religion to a fanatical terrorist. We have different degrees of seriousness and different degrees of incentive to misrepresent the facts.

The risk score can range from 0%, representing complete absence of risk, to 100%. The higher the score, the greater is the risk of accounting manipulation. Anything at 75% or higher might be considered a poor score. About a quarter of all companies have a score in this range. If you were planning to invest in a company with a score in this range, you might want to scratch the fixture.

Once we have these scores, a barrage of questions inevitably follow: Where are these dubious enterprises located? Are they all in Australia as many New Zealanders suspect? Are they concentrated in a particular sector? Are they big or small?

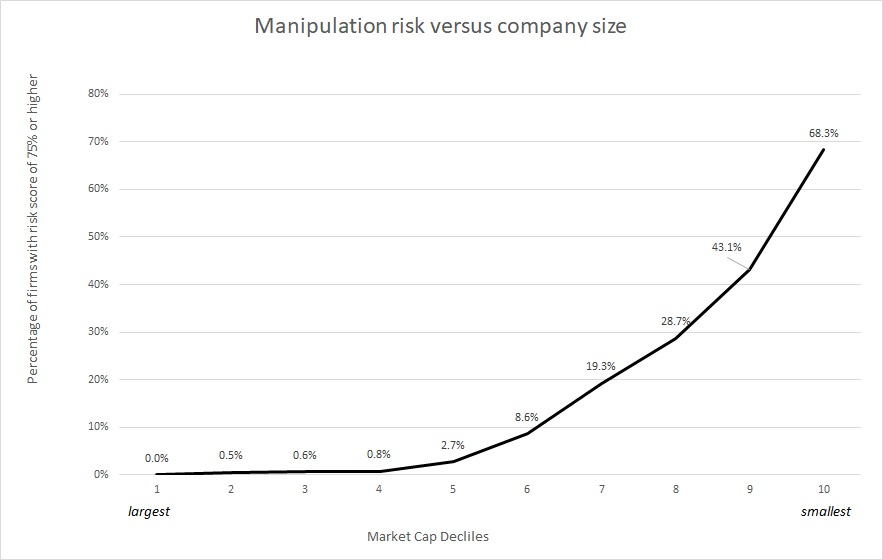

Let’s look at the chart…

This chart divides all the companies in our global coverage into size deciles, measured by market capitalization. The size deciles are shown on the horizontal axis. Decile 1 represents the very largest companies, whereas decile 10, at the extreme right, contains the minnows.

On the vertical axis we show the percentage of companies in each decile with a score of 75% or higher.

There is a prodigious relationship between firm size and accounting manipulation risk. Deciles 1 through 4, representing 40% of our global coverage, contain a mere three companies with a risk score of 75% or higher. This doesn’t mean that large companies don’t manipulate their accounts, only that the risk of severe manipulation leading to possible failure is low.

“There is a prodigious relationship between firm size and account manipulation risk.”

Beyond decile 4, the risk of manipulation rises intensely as firm size declines. In decile 10, which contains the very smallest companies, a staggering 68.3% of firms are at risk of potentially serious accounting manipulation.

“… passive investment in small caps makes no sense”

The lessons we derive from this experiment are many. Small companies are a lot riskier compared to large companies…more than the general populace is likely aware of. Given the high percentage of small caps that are problematic, the long-term outperformance of small caps must come from a small number of companies. This being true, passive investment in small caps makes no sense. If one wishes to exploit opportunities in small caps, one must find a manager that focuses, above all else, on understanding governance within these small firms.